Immersive Introduction

Imagine holding in your hands the key to your own home in Japan—a symbol of entry into a unique world, where the serenity of ancient temples harmonizes with ultramodern cities renowned for their technology and comfort.

In this article, you’ll find an informative overview of essential aspects: legal procedures, market characteristics, options for property management from abroad, and general tax considerations. Explore the main factors to consider when researching real estate opportunities in Japan, and learn what steps are commonly involved in acquiring and maintaining a property.

Requirements for foreigners

Japan imposes no restrictions on nationality or visa status when purchasing property: tourists on short-term visas, temporary residents, and non-residents alike can sign a purchase agreement and assume full ownership without additional permits. Additionally, there are no limitations on area or property type: buyers may acquire properties ranging from compact Shinjuku apartments to traditional hot-spring houses (onsen-bunka) in Kyushu, provided that standard registration procedures are observed.

Required documentation

No visa or prior authorization is needed. However, international buyers should have the following ready before proceeding:

- Government-issued photo ID: e.g. passport or equivalent document from your home country.

- Proof of residency: e.g. a certificate of residence from your local municipality or a notarized equivalent.

- Any additional documents: as required by local authorities for high-value transactions.

Property registration

After signing the sales contract (売買契約書), the next step is registration with the Property Registry (登記). Under Japanese law, you must submit:

• A certified copy of the sales deed

• Payment of the registration tax (登録免許税), which ranges from 0.1 % to 0.4 % of the registered value, depending on whether it covers land, building, or trust interests

• In some cases, a revenue stamp (印紙税) affixed to the contract, with rates set according to the transaction amount

Once the procedure is complete, the new owner receives a Registration Certificate (登記事項証明書). This certificate is enforceable against all third parties (erga omnes) and grants full rights of disposition, inheritance, and leasing.

Associated taxes

Japan’s tax system is renowned for its clarity. The main levies are:

• Real Estate Acquisition Tax (不動産取得税)

– One-time fee upon purchase

– Based on statutory cadastral value, typically lower than market price

– Standard rate 4 %, reduced to 3 % for certain land and residences under qualifying use

• Fixed Asset Tax (固定資産税)

– Annual, billed in four installments (April, July, December, February)

– Based on the assessed cadastral value

– Rate varies by municipality

• City Planning Tax (都市計画税)

– Applied in designated zones, up to an additional 0.3 % of the same base

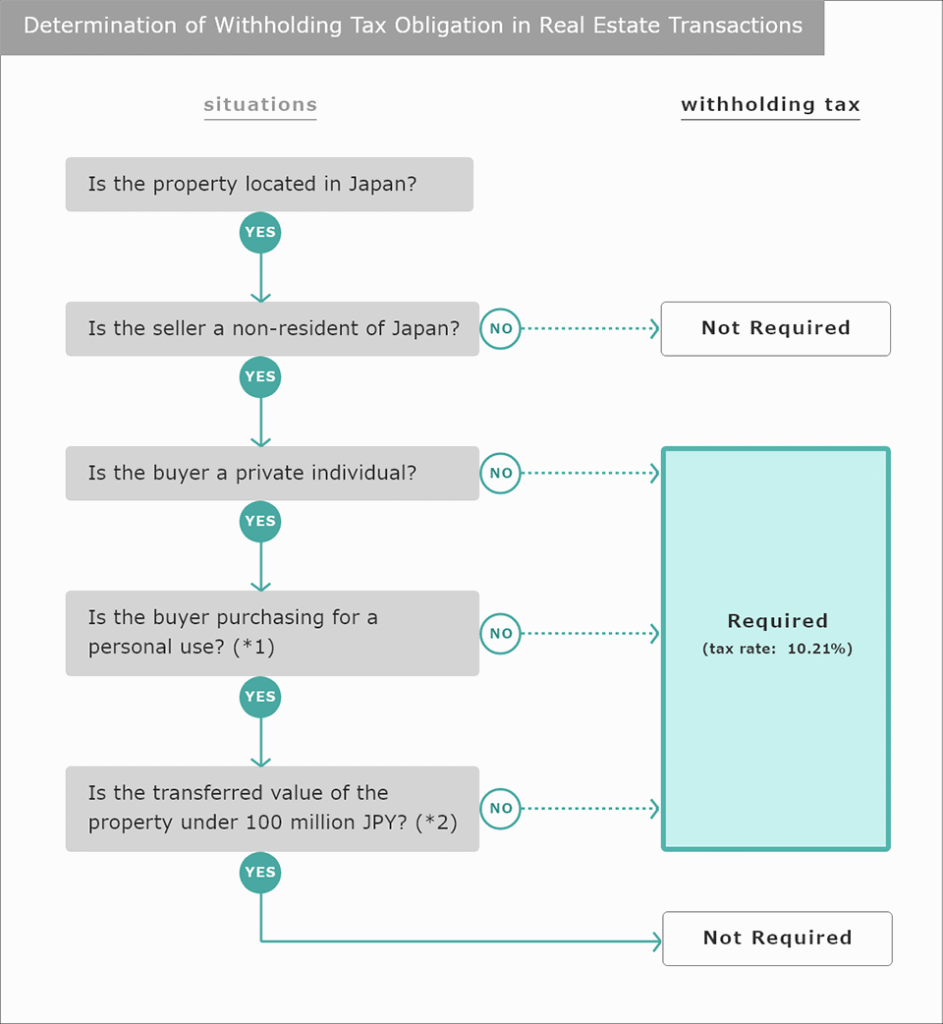

• Non-resident income tax withholding

– If the seller is non-resident, the buyer must withhold 10.21 % of the purchase price and remit it by the 10th of the following month

Non-resident must appoint a tax agent (納税管理人) in Japan to receive notices and make payments, avoiding penalties.

Rental Market Overview

Short-term rentals (minpaku and STR)

Properties in Tokyo, Kyoto, and Osaka often accommodate vacation stays due to high tourist demand, especially during peak seasons.

Long-term rentals

University districts (e.g., Tsukuba, Sapporo) and urban business centers (e.g., Umeda in Osaka, Minato Mirai in Yokohama) maintain steady occupancy rates, driven by students and corporate expatriates.

Rental demand from tourists or residents

Post-pandemic tourism resurgence has turned Japan into a dream destination: visitors from the U.S., Mexico, Australia, and Singapore fill airports and accommodations. In 2023, vacation rentals generated USD 5.605 billion, with projections of USD 7.6 billion by 2030. Meanwhile, the resident foreign population (1.7 million in 2024) drives mid- and long-term rental demand, helping property owners manage seasonal variations in occupancy.

Overview of Corporate Structures and Tax Considerations

In Japan, corporate forms such as GK (Godo Kaisha) and TMK (Tokutei Mokuteki Kaisha) include provisions related to asset depreciation and deductible operating expenses (maintenance, insurance, management). Certain properties certified under the Long-Life Housing Quality Certification program may qualify for tax exemptions. Rental income paid to non-residents is subject to a withholding tax (currently 20.42 %), which may be creditable under applicable double-tax treaties.

Freedom to purchase without special permits

Under Japanese law, property acquisitions are largely unrestricted—except in strategic land zones (airports, military facilities), which constitute less than 2% of the territory. This legislative framework grants buyers the autonomy to acquire, renovate, lease, or sell real estate without additional bureaucracy.

Remote property management

Non-resident property owners can delegate tasks to specialized agencies:

- Certified property management agencies handle rent collection, utilities oversight, and maintenance coordination.

- Licensed tax agents oversee local and national tax filings to ensure compliance and prevent penalties.

- Cloud-based platforms provide real-time occupancy, revenue, and expense reporting, accessible 24/7 from any device.

This arrangement allows property owners to benefit from ownership in Japan without onsite involvement.

Payment of taxes and services

The Japanese fiscal calendar is clearly defined:

• April: annual tax or first installment due

• July, December, February: subsequent property tax installments

• Three to six months post-purchase: acquisition tax notice issued

A licensed management agency or tax representative handles notifications, arranges bank direct debits, and ensures timely filings to help avoid a 14 % late surcharge.

Language barriers in the purchase process

JJapan’s dual writing system and legal complexity can create uncertainty. Specialized firms offer:

• Certified contract translations

• Bilingual accompaniment during property visits and document signings

• Clear explanations of clauses (surface rights, local easements, etc.)

At Akiyas Japan (www.akiyasjapan.com), our multilingual team assists clients throughout the entire process, ensuring an experience as seamless as a stroll through Arashiyama’s bamboo groves.

Does property purchase help obtain a visa or residency?

Buying real estate alone does not grant a visa, but it opens pathways:

• Business Manager Visa (経営・管理ビザ): requires establishing a Japanese entity and presenting a credible business plan.

• Highly Skilled Professional Visa (高度専門職): points are awarded based on capital investment and economic activities, with accelerated permanent residency eligibility.

A robust real estate strategy can strengthen applications and expedite immigration procedures. Akiyas Japan provides translation and interpretation services for visa-related documentation as part of a broader international mobility project.

Residency options

- Temporary Business Visa (1 year, renewable)

- Long-Term Residency after seven years in Japan—or three years under the Highly Skilled Professional route

- Permanent Residency after five to ten years, facilitated by demonstrating economic ties (properties, businesses)

Each immigration step brings greater stability and deeper immersion in Japanese culture.

Conclusion: the wonders of Japan

Beyond contracts and figures, Japan offers a tapestry of contrasts: ancient temples whispering samurai legends; neon-lit cities pulsating with innovation; bullet trains gliding at 320 km/h through fairy-tale landscapes; and smart homes where daily life feels futuristic. Here, safety is not a slogan but a lived reality—crime rates are minimal, and streets inspire confidence at any hour. Nature’s beauty, from cherry blossoms to sacred mountains, invites reflection. Modernity, with its technological solutions, redefines comfort and efficiency.Discovering Japan means immersing yourself in an atmosphere where tradition and the future converge in perfect harmony. It is a society that values attention to detail, quality, and courtesy. For visitors, this archipelago is more than a destination; it is a haven of opportunity—a canvas where experiences unfold with the delicacy of a centuries-old bonsai tree.

Your gateway to the perfect home in Japan awaits at www.akiyasjapan.com.